FCC Preparing in Case Spectrum Auction Authority Returns

Randy Sukow

|

The FCC yesterday began preparing for the return of spectrum auctions. Dating back to the early 1990s, most industry observers have praised auctions as an efficient method for assigning frequencies to wireless carriers while at the same time contributing billions of dollars to the U.S. Treasury. The Commission held its last auction in 2022 and in early 2023, Congress allowed the FCC’s auction authority to lapse.

The current mood on Capitol Hill seems to favor restoring auction authority, although age-old conflicts between government-controlled and commercial spectrum holders complicate the debate. In the meantime, the FCC is moving forward with an auction of a limited set of licenses and has also begun the search for new spectrum to auction in the anticipation of a reauthorization.

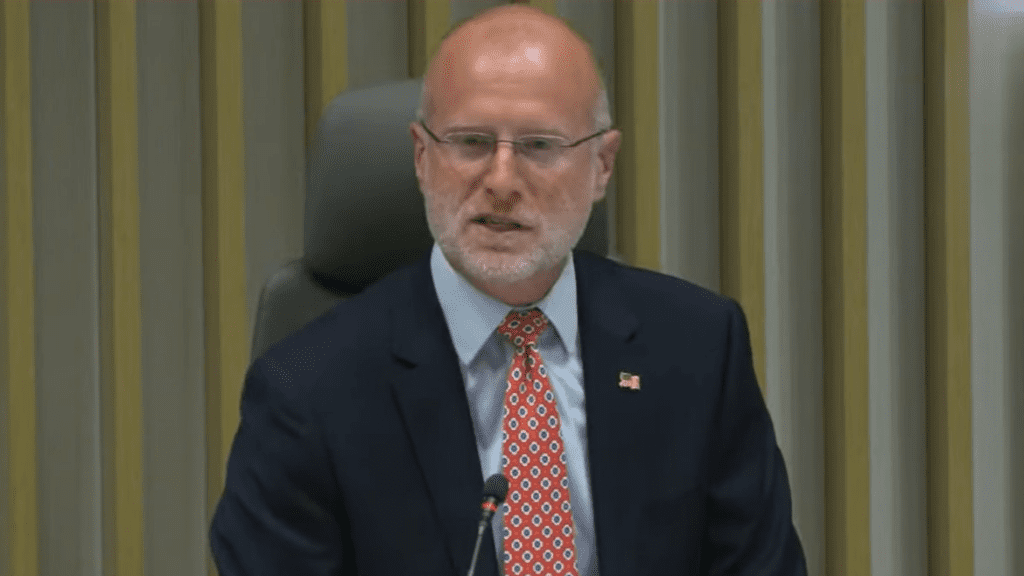

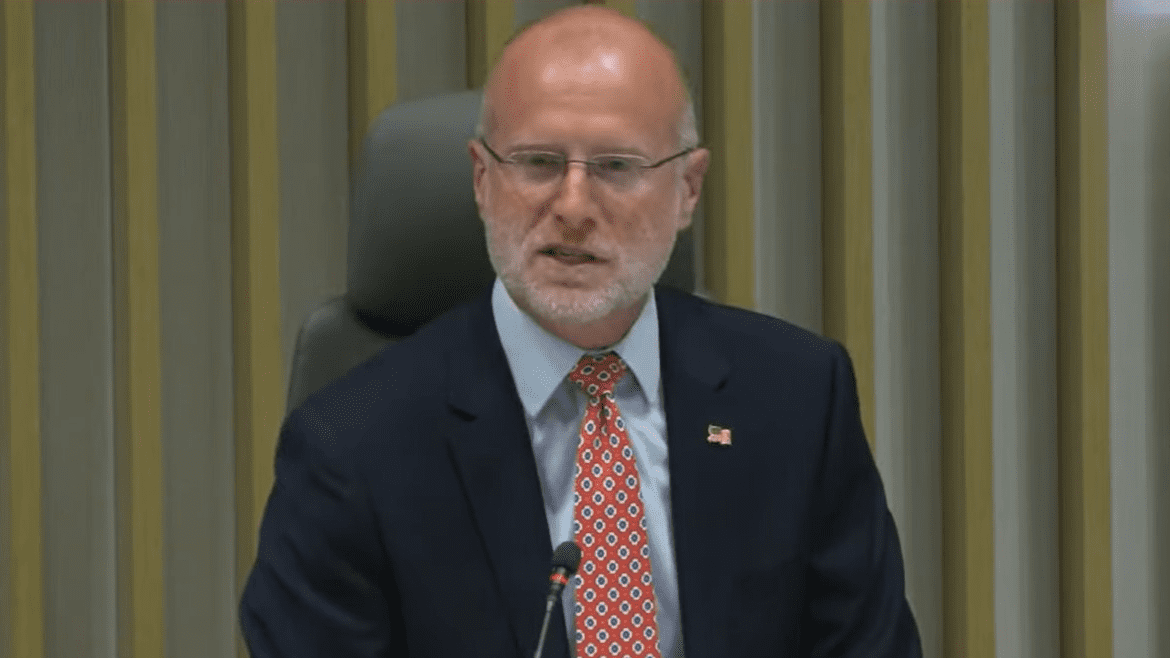

“Late last year, Congress came together and on a bipartisan basis authorized the FCC to auction our inventory of AWS -3 spectrum,” said Brendan Carr leading his first FCC monthly agenda meeting as chairman. “This is a good step forward and I want to commend [former Chairwoman Jessica] Rosenworcel for moving quickly after that to prepare a document that allows the FCC to conduct this auction.”

The Commission, during the Thursday meeting unanimously adopted a Notice of Proposed Rulemaking to update some of its auction rules. The aim is to auction AWS-3 licenses (1695-1710 MHz, 1755-1780 MHz, and 2155-2180 MHz) by June 2026. The FCC originally auctioned AWS-3 spectrum in 2015. However, major bidders later defaulted on their licenses, leaving many frequencies for reauction.

Among the newly proposed rules are updates to the Designated Entity bidding credits for rural and small business bidders and to the definition of “small business.” Qualifying rural bidders would be eligible for a bidding credit of 15 percent. The NPRM also calls for proceeds from the auction to go toward reimbursing carriers required to remove wireless infrastructure from Chinese firms Huawei Technologies or ZTE Corp.

At the same meeting, the FCC also launched a Notice of Inquiry into a possible auction of Upper C-band (3.98-4.2 GHz) spectrum if auction authority returns. One of the last auctions the Commission conducted before losing its authority was the lower C-band (3.7-3.98 GHz) in 2020. The hope is that C-band, traditionally used for satellite communications, will serve as spectrum for expanded 5G capacity. Commission staff’s presentation of the NOI noted that the lower C-band auction “brought 5G to communities, including in rural, remote and underserved areas.”

“Freeing up spectrum drives down prices for consumers. It creates jobs and it increases competition,” Carr said.

In Congress, Representative Rick Allen (R-GA) has reintroduced the Spectrum Pipeline Act, a measure that would require the FCC to auction between 1.3 GHz and 13.4 GHz for 5G and other commercial communications purposes within six years. The bill also calls on the FCC to open more unlicensed spectrum. It would require the National Telecommunications and Information Administration (NTIA), which manages government-controlled spectrum, to identify at least 2.5 GHz for reallocation to the FCC for commercial use.

“As spectrum becomes more and more vital for the wireless services and devices we use today, this legislation is a tremendous return on investment for American taxpayers,” Allen said after introducing the bill. But if history is a guide, interagency disputes will make identifying spectrum for auction difficult.

In the Senate, Majority Leader John Thune (R-SD) and Commerce Committee Chairman Senator Ted Cruz (R-TX) are among the strong supporters of the Spectrum Pipeline Act.