Nuclear-Powered Data Centers Could Lead to Competition for Rural Electrics

Randy Sukow

|

A vision of the future shared by some investors and government policymakers has internet data centers located in rural areas to take advantage of lower real estate prices. The task of meeting the enormous energy needs for data centers will lead the facility owners to bypass local, heavily regulated utilities, which will not be agile enough to provide power on the data center owners’ timelines. Instead, data center owners will collocate their own electric power generation with the data center.

Some foresee the growth of rural industrial enclaves, occupied by one or more data centers. The Trump Administration is actively encouraging companies to build new manufacturing facilities in the United States. New factories could locate near the data centers and share power with those independent generators. While some rural electric distribution and G&T cooperatives might be glad to avoid the headache of providing power to data centers, others may find current key accounts migrating to the new alternative.

“I think everyone has a goal toward clean energy, but they realize that you also have a goal to win the [artificial intelligence] race,” said former Congressman Chip Pickering (R-MS), who is currently CEO of industry association INCOMPAS. “You can’t wait on everything to be in place on your electricity side before you begin doing an all-of-the-above big push, whatever it takes to win this moment,” he said at the recent “Data Centers, Nuclear Power and Broadband Summit,” in Washington, DC, hosted by BroadbandBreakfast.

In the early stages, summit panelists predicted investment in natural gas power plants for data centers. “We’re seeing big oil come in and say, ‘Look, we’re going to build you a natural gas power plant. It’s not even the on the grid. And then you can build four data centers right there, and we’re going to be right next to where the gas comes out of the ground. We don’t even need the utility,’” said Christopher Guith, senior VP of the US Chamber of Commerce’s Global Energy Institute.

However, within a few years, expect industrial enclaves to favor nuclear power. Nuclear meets the 24/7 reliability needs of data centers and manufacturing facilities while maintaining zero carbon emissions.

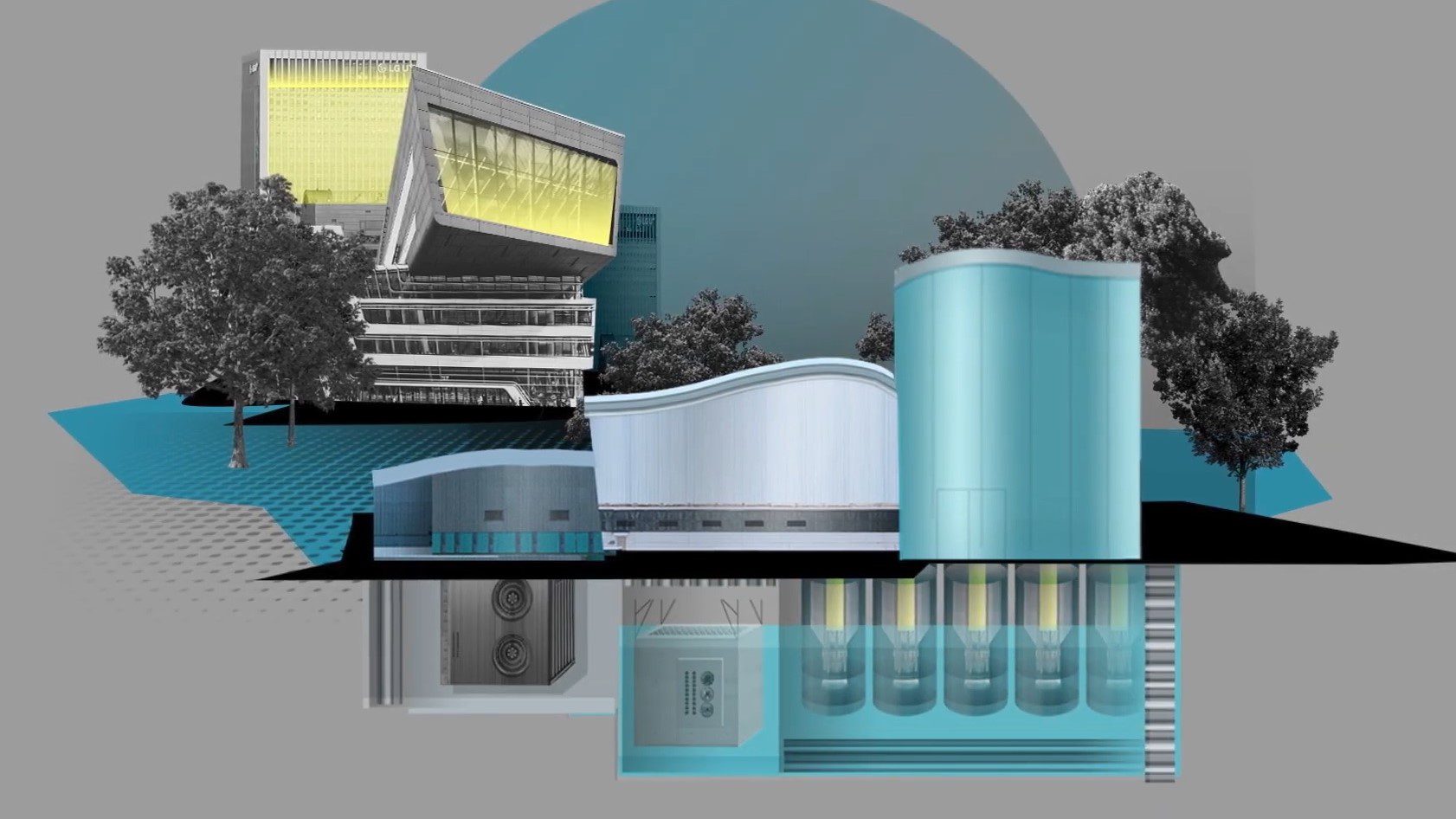

The summit included experts on small modular reactors (SMRs), with modular components that could be mass produced and easily shipped, decreasing the cost of deployment across the nation. SMRs follow the same design as older, traditional reactors, but on a much smaller scale, about the size of a school bus. In addition, SMR deployments can be below ground where they are protected from the weather. (See Department of Energy graphic above.)

In October, Amazon and nuclear technology developer X-Energy Reactor Co. announced a $500 million collaboration to build an SMR facility for a data center in Oak Ridge, TN. X-Energy also recently applied for a construction permit from the Nuclear Regulatory Commission (NRC) to build an SMR plant for Dow in Seadrift, TX.

“We’re talking about demystifying nuclear,” said X-Energy’s Carol Lane, VP of Government Relations, during the summit. The company’s SMR design increases safety by using helium to cool the core rather than water, she said. It has developed a system of graphite “pebbles” infused with its “TRISCO” fuel.

“We put about 220,000 of these pebbles in our reactor core … Think of this as a giant gumball machine,” Lane said. “Then the chain reaction starts off. We flow helium over the pebbles; the helium heats up most of the steam generator into the turbine and produces either high temperature steam or electricity.”

Perhaps the greatest potential barrier to rapid data centers including on-site generation, is permitting and licensing. Panelists estimated it takes about 18 months to build a data center, but the time it takes to secure the permits and power for a data center can take up to five years.

The Commonwealth of Virginia has been actively seeking to facilitate new data center construction. Northern Virginia houses about a quarter of data center capacity in the Americas and 13 percent worldwide. An estimated 70 percent of world internet traffic runs through Virginia. And yet, Virginia government acknowledges there is a problem.

“Since 2020 our data center capacity has doubled, and based on projects in the pipeline, it will double again,” said Julianne Szyper, deputy director of Virginia Department of Energy. “With permitting and all of the processes that have to take place, there’s years delay before things are online.”

Virginia has established a permit tracking website, similar to the Federal Express packing tracking system. “What that did is it exposed where the weak areas were [in the application process] and they weren’t,” Szyper said. They found potential bottlenecks at the state and local levels as well as from the applicants and their consultants. The federal government “is probably where our primary delays are,” she said.

As data centers move more toward nuclear power, panelists predicted that federal approval of new reactors through the NRC will be the chief obstacle. For SMRs, the NRC will also review “fuel cycle facility” issues. Szyper noted that prior to two recent reactor approvals in Georgia, NRC hadn’t licensed any reactors since the 1990s. A Virginia nuclear project filed an application in April of 2022, which NRC waited until November 2022 to docket.

“They’ve given us between 30 and 42 months to just to approve the fuel facility, which is a whole lot safer than actual a reactor,” she said.

In December, nuclear technology developers and the states of Texas and Utah (later joined by Louisiana) entered a lawsuit against NRC, seeking regulatory relief for small reactors, which remain subject to regulations for large reactors set decades ago.

“SMRs and their even-smaller counterparts [called ‘microreactors’] typically have numerous advantages to traditional nuclear reactors, including lower cost, greater siting flexibility, and faster construction, portending a revolution in nuclear power,” according to the complaint. “The NRC imposes complicated, costly, and time-intensive requirements that even the smallest and safest SMRs and microreactors … must satisfy to acquire and maintain a construction and operating license.”

Update, May 5: Late last week, West Virginia Governor Patrick Morrisey signed the Power Generation and Consumption Act, a bill that aims to attract data centers to the state by encouraging on-site generation of electricity. The act encourages data centers to establish coal and gas-powered microgrids that are exempt from many local and state regulations. It also removes a “requirement that electrical service to business development districts be generated from renewable sources.”